How to Pay Property Tax Online Chennai

In India, property tax is a crucial component of real estate ownership. Whether you own residential, commercial, or industrial property, understanding what property tax is and how to pay it is essential for proper financial planning. Property tax is levied by local municipal bodies based on the assessed value of your land and any structures built on it. This tax helps fund essential public services like infrastructure, sanitation, and utilities, playing a critical role in community living.

With the advent of digital platforms, paying property tax online has become increasingly convenient. Cities across India, such as Bangalore, Hyderabad, Delhi, and Pimpri-Chinchwad, have streamlined the process through dedicated online portals. In Tamil Nadu, cities like Chennai, Coimbatore, Madurai, and Trichy offer similar online payment systems. Here are few steps in depth to pay property tax online Chennai

Key Components of Property Tax in India

1.Assessed Value:

The property tax is calculated based on the assessed value of the land and buildings. This value is determined by local authorities and varies depending on the property’s location, size, and usage (residential, commercial, or industrial). Property owners can check their assessed value on their local municipal website.

2.Tax Rate:

Municipalities across India have different tax rates. For example, BBMP property tax in Bangalore, GHMC property tax in Hyderabad, and MCD property tax in Delhi each have distinct assessment systems and tax rates, impacting your total cost of ownership.

3.Assessment Method:

Municipal bodies use methods such as the Annual Rental Value (ARV) or Capital Value System (CVS) to calculate property tax. Understanding the difference between these methods will help you estimate the property tax for your construction projects.

How to Pay Property Tax Online in India

Paying property tax online has become a simple and efficient way for property owners to manage their tax obligations. The process may vary slightly depending on your city, but here’s a general step-by-step guide to pay property tax online Chennai and also India

1.Visit the Official Municipal Website:

Each city has a dedicated website for property tax payments. For example:

-

Bangalore (BBMP Property Tax): BBMP Property Tax

-

Hyderabad (GHMC Property Tax): GHMC Property Tax

-

Delhi (MCD Property Tax): MCD Property Tax

2.Enter Your Property Details:

Use your Property ID or Assessment Number to retrieve the necessary information.

3.Select Tax Period:

Choose the period for which you are paying the property tax. If there are any arrears, those will be shown too.

4.Verify the Amount:

The system will automatically calculate the tax based on your property details. Ensure that the amount displayed matches your records.

5.Choose Payment Method:

Select your preferred payment method (credit/debit cards, net banking, UPI).

6.Complete the Payment:

After completing the transaction, you will receive an e-receipt. Save or print this for future reference as proof of payment.

Pay the Property Tax Online in Tamil Nadu

In Tamil Nadu, cities like Chennai, Coimbatore, Madurai, and Trichy have streamlined the online payment process through dedicated municipal portals. Here’s how you can pay your property tax online in Tamil Nadu:

1.Gather Necessary Information

Before initiating the payment process, ensure you have the following details ready:

-

Property Identification Details: Survey Number, Ward Number, Tax Receipt Number (if available)

-

Owner’s Details:Name of the Property Owner, Mobile Number, Email Address

-

Payment Information:Bank Account Details (for electronic payments), Credit/Debit Card Information

-

-

2.Visit the Respective Municipal Corporation Website:

-

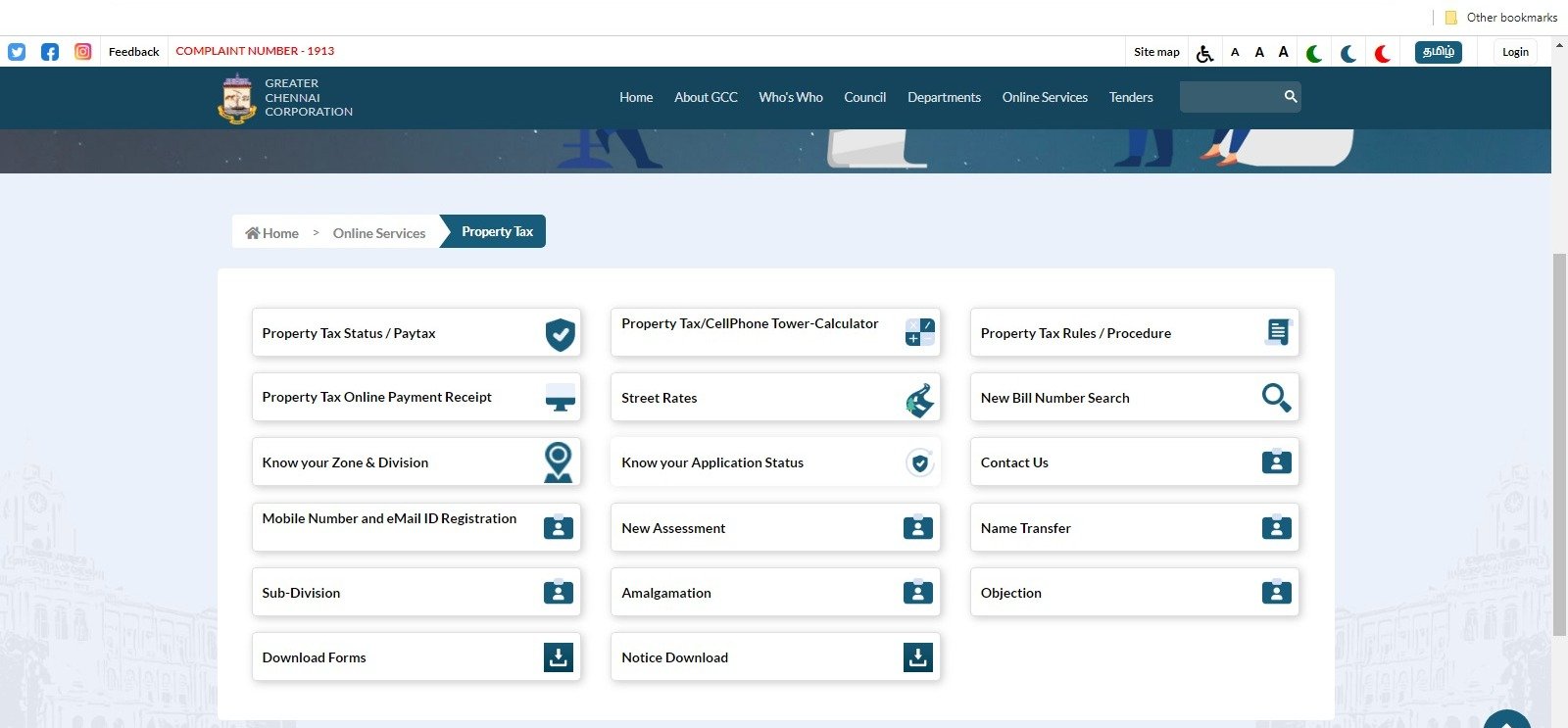

Chennai: Greater Chennai Corporation

-

Coimbatore: Coimbatore City Municipal Corporation

-

Madurai: Madurai Municipal Corporation

-

Trichy: Trichy Corporation

3. Go to the Property Tax Payment Section

Once on the homepage:

1.Locate the E-Services Tab:Look for the “E-Services” section on the main navigation menu.

2.Select “Property Tax”: Under E-Services, click on “Property Tax” to access the payment portal.

4. Access the Property Tax Payment Portal

You have two main options to proceed:

A. Using Tax Receipt Number

1.Click on “Pay Property Tax” using your existing tax receipt number.

2.Enter the Required Details:

- Tax Receipt Number

- Ward Number

- Mobile Number

3.Proceed to View Tax Details: Examine the property facts and the amount owed.

B. Without Tax Receipt Number

1.Click on “Search Tax Details” if you don’t have a tax receipt number.

2.Provide Property Identification Details:

- Survey Number

- Ward Number

3.Retrieve Tax Information:The system will display the outstanding tax amount and payment options.

5. Review Tax Details

Carefully verify the following before proceeding with the payment: Owner’s Name,

Property Address, Total Tax Amount Due, Due Date

6. Select Payment Method

To pay property tax online Chennai’s online portal typically offers multiple payment options:

- Credit/Debit Cards, Net Banking, UPI, Electronic Clearing House (E-Ch) Transfers Note: Some payment methods may incur additional processing fees. Check the fee structure before finalizing the payment.

7. Enter Payment Details

Depending on your chosen payment method to pay property tax online select,

-

For Credit/Debit Cards:Enter card number, expiry date, CVV, and cardholder name.

-

For Net Banking:Select your bank and complete the transaction.

-

For UPI:For UPI payments, use your UPI ID or QR code to authorize the transaction.

8.Confirm and Submit Payment

-

Review Payment Summary:Ensure the payment amount and property details are correct.

-

Agree to Terms and Conditions:Check any required boxes to agree to the payment terms.

-

Submit Payment:Click on the “Pay Now” or “Submit” button to process the transaction.

9. Receive Confirmation

After successful payment:

-

Digital Receipt: A confirmation message with a receipt number will appear on the screen.

-

Email/SMS Confirmation: If you provided your email and mobile number, you might receive a confirmation via these channels.

-

Download/Print Receipt: It’s advisable to download or print the receipt for your records.

10. Set Up Automatic Payments (Optional)

To avoid missing future payments:

1.Register for Automatic Payments: Some portals offer the option to set up recurring payments.

2.Provide Authorization: Authorize the portal to deduct the tax amount automatically from your chosen payment method on due dates.

Important Tips for Property Owners in Tamil Nadu:

-

Keep your Property ID ready to streamline the process.

-

Pay before the deadline to avoid late fees or penalties.

-

Safely store your e-receipt as official proof of payment.

-

Verify any changes in property details or tax rates annually.

How to Save Capital Gain Tax on Sale of Residential Property

-

Section 54 Exemption: Under Section 54 of the Income Tax Act, if you reinvest the proceeds from selling a residential property into another residential property, you can claim exemption from capital gains tax.

-

Capital Gains Account Scheme: If you’re unable to reinvest the sale proceeds before filing your taxes, you can deposit the amount in a Capital Gains Account Scheme to avail of tax exemption later.

How to Save Tax on Sale of Property

For non-residential property, understanding how to save tax on the sale of property is crucial. You can:

-

Invest in Bonds: By investing in bonds under Section 54EC, you can claim exemption from long-term capital gains tax.

-

Utilize Tax Deductions: If you use the funds to buy a new property, you can offset the gains against the cost of the new property.

Property Tax Rebate or Exemptions

Many states and municipalities offer rebates or exemptions that can help reduce the property tax burden:

-

Senior Citizens: Property tax reductions may be available for senior citizens in some cities.

-

Disabled Persons: Concessions for disabled individuals can provide relief.

-

Agricultural Land: Some agricultural lands may be exempt from property tax or have lower rates.

Online Property Tax Payment Troubleshooting

While paying property tax online is convenient, issues may arise. Here are some common challenges and solutions:

-

Website Downtime: Municipal websites may occasionally be unavailable. If you encounter issues, try again later.

-

Payment Failure: If a payment fails, check your payment method and ensure all details are correct before retrying. Make sure your browser is compatible and pop-up blockers are disabled.

-

Incorrect Property Details: If there are discrepancies in your property details, contact the municipal office for corrections before making payments.

Tax Implications for Different Property Types

Property tax rates and assessments may vary based on the type of property:

-

Residential Properties: Generally have different rates compared to commercial or industrial properties, impacting your overall tax liability.

-

Commercial and Industrial Properties: These may face higher tax rates due to their potential for generating more revenue for local governments.

How Property Tax is Used by Municipalities

Understanding how property taxes are utilized can help property owners appreciate their contribution to local services:

-

Property tax revenue is essential for maintaining public services such as roads, sewage systems, schools, and public healthcare facilities.

-

Knowing that your tax payments contribute to community development can provide a sense of responsibility and ownership.

Also visit : How to Download EC online in Tamilnadu

Conclusion : Pay property tax online Chennai

Paying property tax online in both India and Tamil Nadu has become an efficient, hassle-free process for property owners. Whether it’s through the BBMP property tax portal in Bangalore, the GHMC property tax portal in Hyderabad, or the Greater Chennai Corporation in Tamil Nadu, Especially Pay property tax online in Chennai follow these steps to fulfill your tax obligations are straightforward and secure. By following the steps outlined above, you can ensure timely payment and avoid penalties.

Staying compliant with property tax regulations is essential for property management, and using online platforms can make this process smoother and more convenient. Take advantage of these digital services to ensure you’re on top of your property tax payments, contributing to the development of vital public services in your area.