Stamp Duty, and Registration Charges in Bangalore 2025

Buying land or property is a significant financial investment, and understanding the legal requirements is crucial to ensure a smooth transaction. Land registration is a mandatory process that provides legal ownership of a property, making it enforceable in a court of law. When you buy a property in Bangalore, one of the biggest costs—apart from the price of the property itself—is stamp duty and registration charges in bangalore 2025. These Property registration costs bangalore Sept 2025 are mandatory legal expenses you must pay to officially register the property in your name.

Recently, the Karnataka government has revised property registration fees, which means home-buyers and investors need to be aware of the updated costs before planning a purchase. This blog covers everything you need to know about land registration, stamp duty in Bangalore, registration charges in Bangalore, and the necessary documents required for the process.

What is Land Registration?

Land registration is the process of legally recording the ownership of a property with the local government authority. It provides the buyer with a legal title, protects against fraudulent claims, and ensures a smooth transfer of ownership in the future. The process involves paying the applicable stamp duty and registration charges before the property is officially transferred to the new owner.

Registration Charges in Bangalore Latest Update (Effective August 31, 2025)

Stamp duty is a tax levied by the state government on property transactions to make them legally valid. In Bangalore, the Karnataka government has fixed different stamps and registration , duty rates based on the property value. As per 2025 stamp duty and registration charge update, the current charges are:

1. Registration Charges Doubled

The registration fee in Karnataka has been doubled from 1% to 2% of the property value. With this hike, the overall property transaction cost in Bangalore has gone up.

* Stamp Duty: 5%

* Registration Fee: 2% (earlier 1%)

* Cess & Surcharge: ~0.6%

* Total Cost: ~7.6% of property value

For example, if you are buying a property worth ₹1 crore, you will now spend around ₹7.6 lakhs in stamp duty, registration, and related charges.

2. Stamp Duty Rate Remains Unchanged

The stamp duty continues to be based on the property value:

* 2% for properties up to ₹20 lakh

* 3% for properties between ₹20 lakh and ₹45 lakh

* 5% for properties above ₹45 lakh

Why Was the Registration & Stamp Duty Charges Bangalore Increased?

The Karnataka government has cited revenue shortfalls from property registrations in FY 2024–25 and FY 2025–26. By raising the registration fee, it expects to collect an additional ₹2,500–3,000 crore, which will be used for welfare schemes and administrative requirements.

Officials also point out that Karnataka is still competitive compared to neighboring states:

* Kerala: ~10%

* Tamil Nadu: ~9%

* Telangana & Andhra Pradesh: ~7.5%

Impact on Homebuyers

This new stamp duty charges in Bangalore 2025 revision directly impacts property buyers in Bangalore:

Higher upfront costs – A ₹1 crore property now costs ₹1 lakh more in registration fee compared to earlier

Affordable & mid-segment housing affected – First-time buyers and salaried families may feel the pinch more.

Slower market movement – Experts predict a dip in property registrations and slower inventory absorption in the coming quarters

Still attractive for investors – Despite the increase, Bengaluru remains a preferred market due to its IT growth, infrastructure, and rental demand.

Stamp duty charges in Bangalore 2025 must be paid before executing the property sale agreement, and failure to do so can result in legal complications.

How to Calculate Stamp Duty Charges in Bangalore

Based upon the recent update on Stamp duty charges in Bangalore 2025, they charges are calculated based on the property’s market value or sale deed value, whichever is higher. Here’s how you can calculate it:

Step-by-Step Calculation of Stamp Duty in Bangalore

1.Determine the Property Value

-

Get the guidance value (set by the government) or the actual sale price of the property.

-

The higher of these two values is considered for stamp duty calculation.

2.Apply the Stamp Duty Rate

Stamp duty in Bangalore is charged as per Karnataka Government rules.

* 2% for properties up to ₹20 lakh

* 3% for properties between ₹20 lakh and ₹45 lakh

* 5% for properties above ₹45 lakh

3.Add the Registration Charges

-

2% of the property’s market value is added as a registration charge.

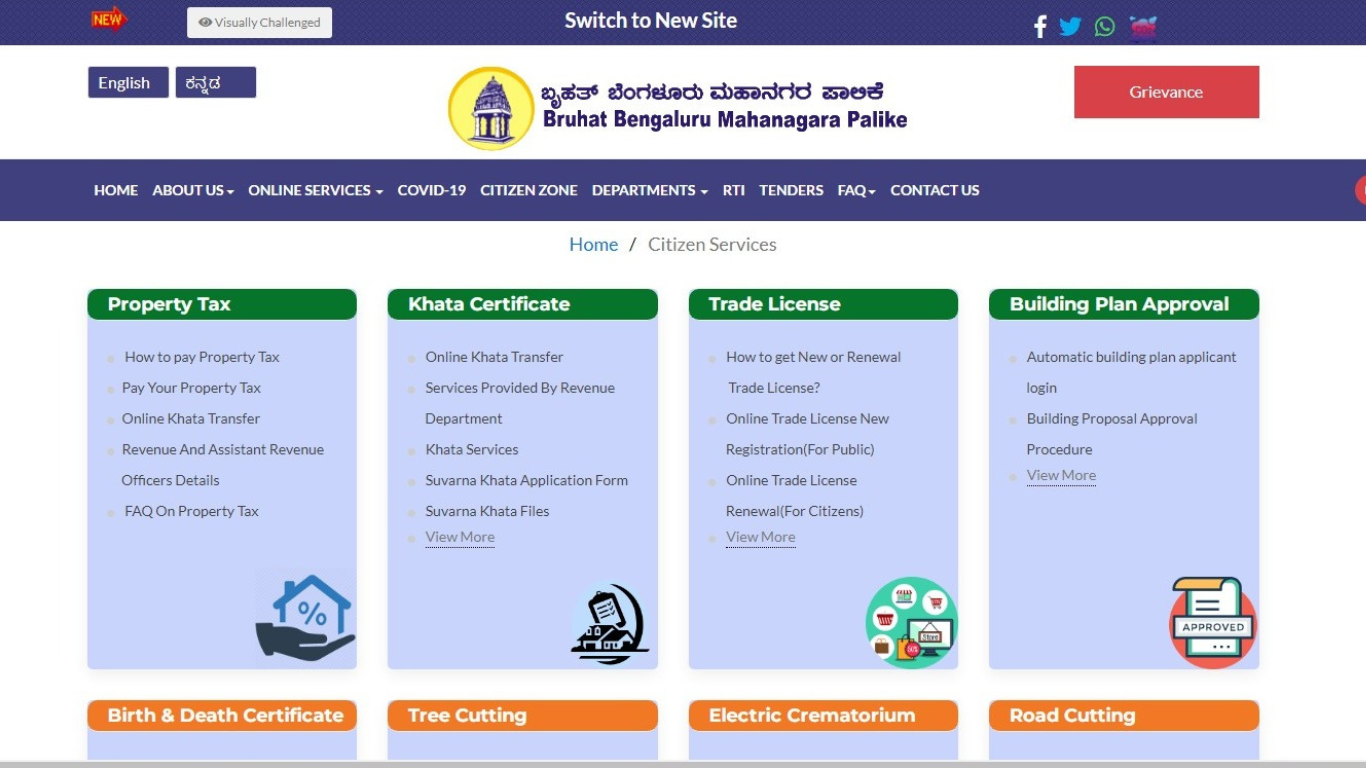

What is a Khata Certificate?

A Khata Certificate is an important document issued by the Bruhat Bengaluru Mahanagara Palike (BBMP) or local municipal authorities in Bangalore. It certifies that a property is legally recorded in the municipal records and is used for tax assessments and property ownership verification.

Purpose of a Khata Certificate

Property Tax Assessment – Required to pay property taxes.

Legal Ownership Proof – Confirms that the property is officially registered.

Building Permits & Loans – Needed for obtaining building approvals and home loans.

Property Transfer & Sale – Essential for selling or transferring property ownership.

Types of Khata in Bangalore

-

A-Khata – Issued to properties that meet all legal requirements, have approvals, and have paid property taxes.

-

B-Khata – Given to properties that do not comply with legal regulations, often requiring regularization.

Documents Required to Obtain a Khata Certificate

How to Apply for a Khata Certificate?

-

Submit an application at the BBMP office or online through the Sakala portal.

-

Attach required documents and pay the necessary fees.

-

The BBMP verifies the details and issues the certificate within a few weeks.

Documents Required for Land Registration

To complete the land registration process in Bangalore, the following documents are required:

-

Sale Deed – A legal document proving the transfer of property ownership.

-

Encumbrance Certificate (EC) – Ensures that the property is free from legal dues or liabilities.

-

Khata Certificate & Extract – Provides property details and is required for tax assessments.

-

Tax Paid Receipts – Proof that property taxes are up to date.

-

Identity Proof of Buyer & Seller – Aadhaar card, PAN card, or passport for verification.

-

Property Layout Approval Plan – Issued by the local authority to validate the property’s layout.

-

Occupancy Certificate (if applicable) – Confirms the property’s compliance with approved construction plans.

-

Power of Attorney (if applicable) – If someone is executing the transaction on behalf of the owner.

Steps for Land Registration in Bangalore

Stamp Duty Payment – Pay the applicable stamp duty charges Bangalore 2025 or at an authorized bank.

Drafting of Sale Deed – Prepare a sale deed on stamp paper, signed by both parties.

Property Registration – Visit the Sub-Registrar’s Office with required documents.

Verification & Biometric Authentication – The registrar verifies details, takes biometric authentication, and records the transaction.

Issuance of Registration Certificate – Once registered, the buyer receives the title deed as proof of ownership.

Common Mistakes to Avoid During Registration

Penalties for Non-Payment of Stamp Duty

Not verifying property ownership and legal clearances before purchase.

Incorrect calculation of stamp duty leading to additional payments or penalties.

Delaying property registration, which may result in legal disputes.

Not checking the encumbrance certificate to ensure no legal liabilities on the property.

Ignoring the importance of a Khata certificate for property tax assessments.

Failure to pay stamp duty and register property on time can lead to:

A penalty of up to 2% per month, subject to a maximum of 200% of the deficient amount.

The property transaction being considered invalid in legal disputes.

Additional interest and legal action by authorities.

Online Registration Process in Bangalore

The Karnataka government has simplified property registration by introducing online payment options. Steps include:

Recent Updates & Government Notifications

The Karnataka government periodically revises stamp duty and registration fees. Recent updates include:

Updated Example of Registration & Stamp duty charges Bangalore 2025

Here’s how the new stamp duty and registration charges in Bangalore work out:

| Property Value | Stamp Duty | Registration Fee(2%) | Cess (0.6%) | Total charges (approx) |

| ₹50 | ₹2,50,000 | ₹1,00,000 | ₹30,000 | ₹38,0000 |

| ₹75 | ₹3,75,000 | ₹1,50,000 | ₹45,000 | ₹57,0000 |

| ₹1 | ₹5,00,000 | ₹2,00,000 | ₹60,000 | ₹76,0000 |

| ₹1.5 | ₹7,50,000 | ₹3,00,000 | ₹90,000 | ₹1,14,000 |

✅ Key Takeaways for Buyers

* Stamp duty in Bangalore 2025 remains at 5%, but registration fee has doubled to 2%.

* Including cess/surcharge, expect to pay around 7.6% extra on top of your property price.

* Always calculate these charges before finalizing your budget.

* Engage with a trusted property consultant to avoid hidden costs.

List of Stamp Duty and Registration Charges in Karnataka 2025 for property registration

| S.NO | DESCRIPTION | STAMP DUTY FEES | REGISTRATION FEES |

|---|---|---|---|

| 1 | Agreement relating to sale of Immovable Property | ||

| With possession | 5% on the market value | 1% | |

| Without possession | 0.5% on market value equal to the amount of consideration, Min ₹500 | ₹200 | |

| Joint Development agreement | 2% | 1% | |

| 2 | Conveyance (Including flats/Apartments) | 5% of market value + surcharge + additional duty | 1% |

| 3 | Exchange | 5% of market value + surcharge + additional duty | 1% |

| 4 | Gift | ||

| If donee is not a family member of donor | 5% of market value + surcharge + additional duty | 1% | |

| If donee is a specified family member of donor |

₹5,000 – BMRDA, BBMP, City Corporation ₹3,000 – City/Municipal Council/Town Panchayat ₹1,000 – Others |

₹500 (fixed) | |

| 5 | Mortgage | ||

| If possession of property is given | 5% on the amount + surcharge | ₹5 for every ₹25,000 or part thereof | |

| If possession of property is not given | 0.5% + surcharge | 0.5% (Maximum ₹10,000) | |

Conclusion - Stamp Duty Charges in Bangalore 2025

Understanding land registration, stamp duty, and registration charges is crucial for hassle-free property transactions. Ensuring that you have all the required documents and following the legal procedures can prevent future disputes. If you are purchasing land in Bangalore, this details on stamp duty charges and registration charges Bangalore 2025 blog helps the process easy & ensure compliance with state regulations.

At Noah Infrastructures, we help property buyers, investors, and homeowners stay updated with the latest real estate news, government policies, and market insights. Stay tuned for more updates on Bangalore’s property trends.

Also Visit: Stamp duty charges in Chennai !