PF Withdrawal for House Construction

Building your dream home is one of life’s biggest milestones, but financing it can sometimes be challenging. To ease this financial burden, the Employees’ Provident Fund Organisation (EPFO) allows employees to withdraw their Provident Fund (PF) savings for house construction. If you’re planning house construction in Chennai or elsewhere, understanding the process and requirements for PF withdrawal for house construction is essential.

Why PF Withdrawal for House Construction is Important?

PF savings act as a financial safety net during significant life events, such as building a house. The EPFO’s facility to withdraw funds for house construction helps reduce dependency on loans and high-interest rates. By using your accumulated PF savings, you can significantly ease the financial stress involved in the house construction process and move closer to owning your dream home.

Eligibility for PF Withdrawal for House Construction

Before applying for a PF withdrawal for house construction, ensure you meet the following eligibility criteria:

Minimum Years of Service:

You must have completed 5 years of continuous PF contributions. This ensures that your PF account has sufficient funds for withdrawal.

Purpose of Withdrawal:

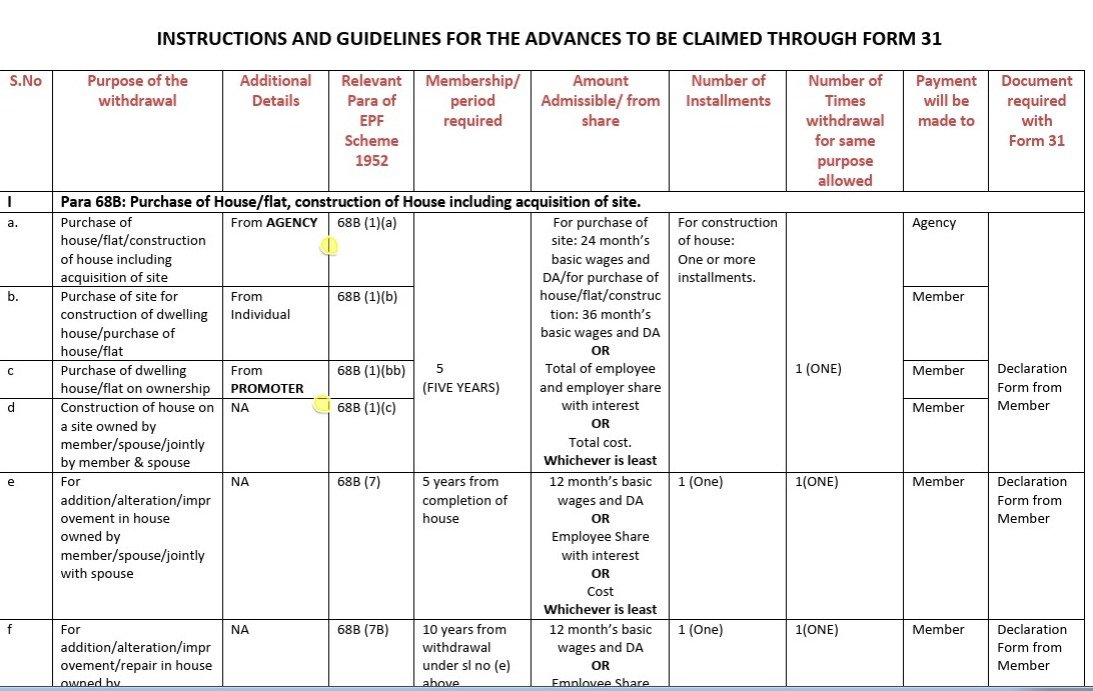

PF withdrawal is permitted for the following purposes:

-

Construction of a house on land owned by you, your spouse, or jointly.

-

Purchasing a plot to construct a house in the future.

Amount Eligibility:

You can withdraw up to 90% of your total PF balance, which includes employer and employee contributions along with accrued interest.

Ownership Criteria:

The land or house must be registered in your name, your spouse’s name, or jointly with your spouse. Ensure proper documentation of ownership, especially for properties in cities like Chennai, where verification processes are more stringent.

Completion Timeline:

The house construction process must be completed within 6 months from the date of PF withdrawal. Proof of completion may be required by the EPFO.

Documents Required for PF Withdrawal

To apply for PF withdrawal for house construction, you need the following documents:

Step-by-Step Procedure for PF Withdrawal

Here is the complete process for withdrawing PF funds for house construction:

Visit the EPFO website and log in with your UAN (Universal Account Number) and password.

Key Points to Remember

Eligibility Timeline for PF Withdrawal for House Renovation:

1.After 5 Years of Service

To be eligible to withdraw your PF savings for house renovation, you must have completed at least 5 years of continuous service with the same employer. This ensures that you have accumulated sufficient funds in your PF account to make the withdrawal.

2.Frequency of Withdrawal:

-

You are eligible to withdraw PF for house renovation only once during your entire career.

-

This means you can use your PF savings for either constructing a house or renovating an existing one, but not multiple times for different purposes.

3.EPF Guidelines

After using the PF for house renovation or construction, you will not be allowed to take another withdrawal for a similar purpose. However, you can still use PF savings for other emergencies or situations as per the EPFO’s guidelines.

4.Time Between Withdrawals:

Once you have used your PF for house construction or renovation, you can’t make another withdrawal for the same purpose. However, if you have already withdrawn for construction, you can’t use the funds again for a renovation unless you meet certain other conditions such as a gap of 5 years after the first withdrawal. EPFO typically does not encourage repeated withdrawals unless significant time has passed.

5.Renovation Timeframe:

Similar to house construction, the renovation should be completed within 6 months of withdrawing the PF. This is a key point to remember to ensure that your renovation is completed in a timely manner.

Impact on Future Savings

While withdrawing PF savings for house construction can provide immediate financial relief, it’s important to remember that it will reduce your overall retirement corpus. Consider the long-term implications and weigh them against your current financial needs.

PF Withdrawal for House Construction in Chennai

For individuals planning house construction in Chennai, leveraging PF savings can provide substantial financial relief. With rising property costs in metropolitan areas, using your PF to fund the house construction process can help you reduce debt and achieve homeownership more efficiently. However, be sure to check local municipal regulations for construction and property registration, as these can vary by locality. Ensure that you comply with all regional rules to avoid delays in your construction timeline.

Tips for Managing PF Withdrawal

Benefits of Using PF Savings for House Construction

Reduced Financial Burden: Avoid high-interest loans by utilizing your PF savings.

Faster Construction Process:Accessing funds promptly helps streamline the construction timeline.

No Repayment Obligations:Unlike loans, PF withdrawal does not require repayment.

If you’re planning to build your dream home, exploring home construction loans in India can provide the financial support you need to turn your vision into reality.

Conclusion

Utilizing your PF savings for house construction is a smart financial decision that can make the process stress-free and affordable. By following the eligibility criteria, gathering the necessary documents, and adhering to the EPFO’s guidelines, you can seamlessly withdraw funds using the PF Advance Form 31 (Construction of House).

Ready to begin your journey toward building your dream home? Reach out to a financial advisor or contact EPFO for personalized guidance on using your PF savings for construction. Take the first step today and make your homeownership dream a reality!